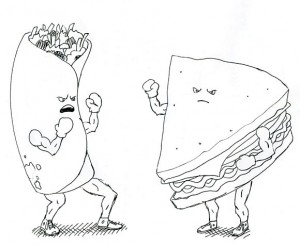

These are the types of questions that come up in the varied curriculum that makes up business school. As accounting students, it is easy to forget that not every subject can be analyzed in the same manner as a financial statement. For instance, the burrito question came up in a business law class that I share with a couple dozen other Traditional MPA students. The problem was that Panera Bread had a contract with a shopping mall that precluded the mall from leasing to other sandwich vendors. The mall subsequently leased to a burrito vendor, so Panera sued on the grounds that a burrito is a sandwich while the mall argued that a burrito is different from a sandwich. Panera lost, presumable because of the obvious differences between burritos and sandwiches. Still, a case like this makes one ponder the gray areas of reality that we have to suss out on a daily basis.

These are the types of questions that come up in the varied curriculum that makes up business school. As accounting students, it is easy to forget that not every subject can be analyzed in the same manner as a financial statement. For instance, the burrito question came up in a business law class that I share with a couple dozen other Traditional MPA students. The problem was that Panera Bread had a contract with a shopping mall that precluded the mall from leasing to other sandwich vendors. The mall subsequently leased to a burrito vendor, so Panera sued on the grounds that a burrito is a sandwich while the mall argued that a burrito is different from a sandwich. Panera lost, presumable because of the obvious differences between burritos and sandwiches. Still, a case like this makes one ponder the gray areas of reality that we have to suss out on a daily basis.

Even though accounting is known for being a black-and-white, straight-forward discipline where there is always a correct answer, accounting students must still understand that the world does not always operate that way. Although there are seemingly hard and fast rules for financial accounting, such as whether a lease is capital or operating, there is still a gray area even there – sometimes a lease can be operating to one party and capital to the other. Despite SOX prohibiting auditors from providing certain consulting services to clients, firms still push the boundaries of what is acceptable and what is not, quite often straddling a line.

Sometimes ethics plays a role in these types of issues, but sometimes there is no right or wrong or good or bad. There is merely a resolution for the same reason a coin has to land on one side, whether it be heads or tails. In arriving at a conclusion, a creative student can rationalize one side or the other and attempt to convince the reader that their rationale is best (or at least most creative). In some cases, like in tax, an accountant can advocate for the client, but an auditor is not really supposed to advocate for the client, but instead for shareholders or the public in general who may be prospective shareholders. Further, management accountants do not necessarily advocate for anyone, but seek the strategy with the highest tangible benefit.

Is Starbucks a manufacturing company? They aren’t if you think about the typical manufacturing company. But, in order to secure a valuable tax deduction their coffee roasting activities are considered manufacturing because they convert raw coffee beans into brew-able beans. Is this wrong, or are they merely seeking to apply a legitimate law to their legitimate process?

Back to the original burrito/sandwich dilemma. In class, it was not sufficient to merely say, “It is not a sandwich because it is a burrito.” We had to explain why. For instance, one student asserted that bread is different from a tortilla. Another suggested that sandwiches are stacked while burritos are wrapped. The point is that it could be argued either way, and it was, but only one resolution emerged. In accounting, there is only one correct answer, but in reality there can be a plurality of answers and being able to distinguish them creatively is a skill that is difficult, but important, to learn.