Last year I wrote a blog about New Year’s resolutions, so this year I thought I’d switch it up and look at the past year in review. And because accountants love numbers so much, let us take a look at the past year in numbers.

Last year I wrote a blog about New Year’s resolutions, so this year I thought I’d switch it up and look at the past year in review. And because accountants love numbers so much, let us take a look at the past year in numbers.

300: Hours of lost sleep

268: Number of Intermediate Accounting problems worked

750: Cups of coffee drank

64.5: Hours spent researching tax law

90: Number of hours spent at McCombs studying during finals

10: Number of Esteemed Lyceum Speakers

13: Number of football games I wish I we had won

9: Number of football games actually won

11: Number of interceptions thrown by UT quarterbacks in 2012 (ugh, this just pains my heart)

28: Number of volleyball games won on the pursuit of the national championship (and this one warms my heart right back up!)

13: Number of Longhorn medals in the 2012 London Summer Olympics (6 gold, 5 silver, 2 bronze)

67: Number of all-time gold medals won by Longhorns (not a 2012 fact, but this picture definitely went viral in the UT network during 2012)

309: Number of new MPA candidates admitted

2: Number of MPA Council awards given at 2012 spring commencement

100: Number of years UT Accounting has celebrated

7: Number of years in a row UT Accounting has been ranked #1 at the graduate level

2: Number of National Championships won by Longhorns this year

1: Number of med schools coming to the UT Austin community

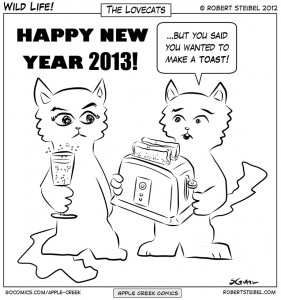

2012 was clearly a fantastic year, and here’s to 2013 being as equally memorable and classy!

Keep it classy, Longhorns.