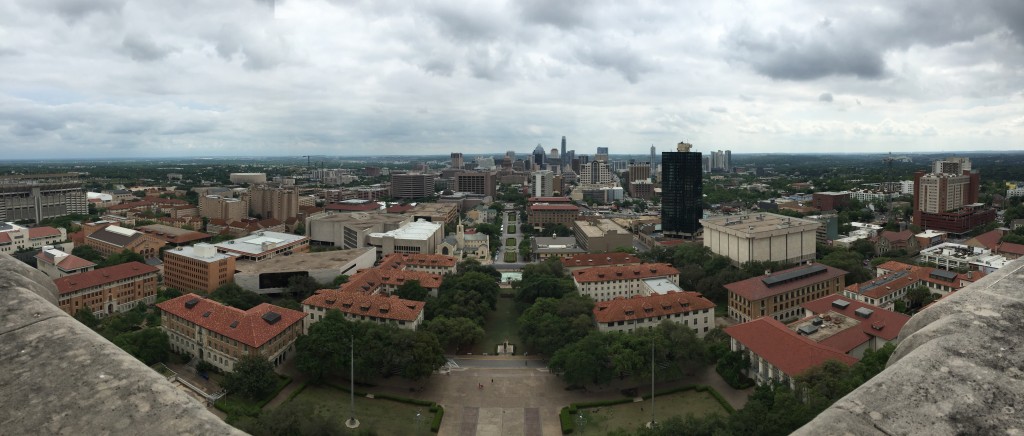

As previously planned, I went on a tour of the UT tower with the MPA Council. The view was great despite the overcast weather (it hailed later that evening!) and is one of the best I’ve seen in Austin alongside those at Mount Bonnell and the 360 bridge overlook. During the summer, the tower also hosts sunrise and sunset tours, which sound awesome. If you have a chance, book a tower tour.

As previously planned, I went on a tour of the UT tower with the MPA Council. The view was great despite the overcast weather (it hailed later that evening!) and is one of the best I’ve seen in Austin alongside those at Mount Bonnell and the 360 bridge overlook. During the summer, the tower also hosts sunrise and sunset tours, which sound awesome. If you have a chance, book a tower tour.

Once the study break was over, I went back to hit the books. This time I went downtown to Cafe Ruckus where a heated giant cookie made for a great study buddy at a giant table by the window. Often I study at home, but when I venture outside, you can find me at one of the following:

1. Flightpath is my favorite cafe in Austin. The place has friendly baristas, good tables, lots of outlets, and a wide array of tasty drinks and snacks. This is a place you can camp out for the day (as I did during Fall semester finals). If only it were open past 11 PM.

2. Thunderbird on Koenig has huge, wooden tables that make for great group study (or fulfill the needs of space hogs like myself). Unfortunately, there are no outlets. They have a fuller (and delicious) food menu than does Flightpath. Also open until 11 PM.

3. Epoch is the place to go for all night studying. It’s one of the few 24 hour spots in Austin and thankfully the pizza slices from East Side Pies are available all night long with you.

4. Mozart’s on the lake has stunning views. The drink selection is enormous (too many chai lattes to count) and the place is always crowded. It’s a great place to watch the sun set.

I also would like to give a shout out to Avenue B Grocery, which has been in Austin for over a century. Ross Mason (owner for 25+ years) makes great sandwiches and soups and has a panoply of other goods for sale. Definitely check this place out next time you’re in Hyde Park. If it’s a nice day, sit on the bench swing outside while you eat.

A few weeks ago, MPAC had an opportunity to hear from a couple local entrepreneurs. It was an insightful conversation as Robert Varela and Kristian Zak of

A few weeks ago, MPAC had an opportunity to hear from a couple local entrepreneurs. It was an insightful conversation as Robert Varela and Kristian Zak of

Second, with more women handling the family’s finances, Mr. Pilgrim also observed that women CFPs have become even more in demand. Given the highly personal nature of the profession, it is not far-fetched to expect clients to be able to relate to their advisors, especially the ones helping with their finances. There’s a lot of client interaction in this profession, so solid relationship building skills are absolutely imperative.

Second, with more women handling the family’s finances, Mr. Pilgrim also observed that women CFPs have become even more in demand. Given the highly personal nature of the profession, it is not far-fetched to expect clients to be able to relate to their advisors, especially the ones helping with their finances. There’s a lot of client interaction in this profession, so solid relationship building skills are absolutely imperative.