Brian White is a member of our Department of Accounting faculty and was recently promoted to Associate Professor, effective September 1, 2018. He teaches some of the accounting MBA courses here at Texas McCombs, so you may see him in some of your electives in the near future!

WHERE DO YOU CALL HOME?

Ann Arbor, Michigan is where I was born and lived for most of my childhood. However, my wife’s hometown of Liverpool, England is my adopted hometown. I lived in Liverpool for ten years, our three kids were born there, and we go back at least two or three times every year.

WHERE DID YOU ATTEND SCHOOL?

I received a BS in Foreign Service from Georgetown (I originally planned to pursue a career as a diplomat), an MS in African Studies from University of Edinburgh, an MBA from Manchester Business School, and a PhD in Accountancy from University of Illinois

WHY DID YOU CHOOSE TO STUDY ACCOUNTING?

Necessity is the mother of invention. My wife and I bought her family business—a small chain of retail stores based in Liverpool—from her grandparents when we were both 24 years old. She had grown up in the business and I had worked as a retail manager in high school and college, but neither of us had any experience running a business. We divided up the duties, and accounting was one of mine. I quickly decided that I needed some more training, so I applied to the evening MBA program at Manchester Business School. While I was there, I focused on accounting and finance because it was so relevant to what I was doing every day at work: tracking and reporting revenues and expenses, designing compensation plans for our employees, managing the annual audit (which was required for nearly all UK companies back then), etc. I also found I was pretty good at accounting, and it was interesting. Ultimately, I ended up becoming a CPA. When I decided to pursue an academic career, a PhD in accounting was the natural choice.

WHY DID YOU CHOOSE TO WORK AT UT?

The combination of our incredible students, world-class faculty, and the city of Austin made it a very easy choice.

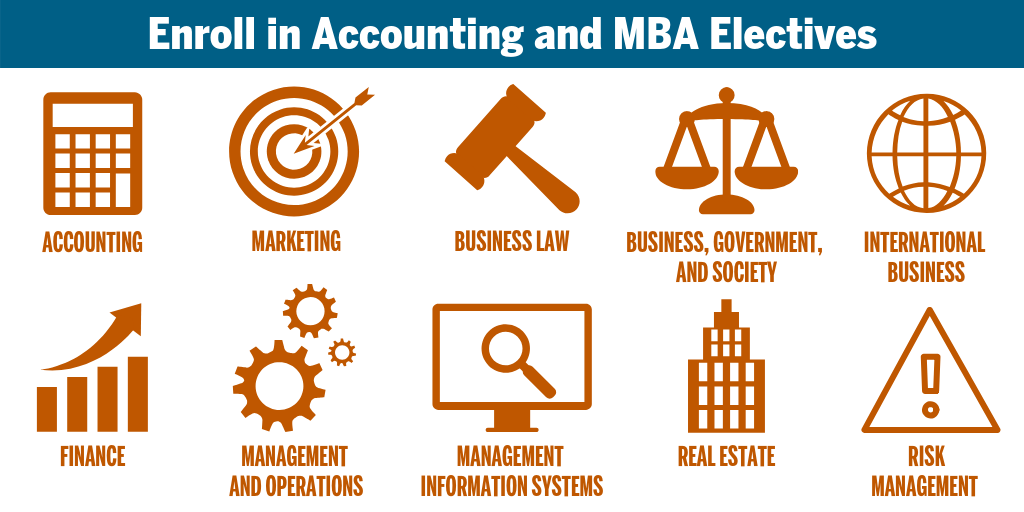

WHAT CLASSES DO YOU CURRENTLY TEACH?

I teach the core financial accounting class to all of our incoming full-time MBA students. I also teach the same course in our Houston MBA program. Next fall, I’m looking forward to teaching the PhD seminar on behavioral research in accounting for the first time.

FAVORITE PUBLICATION THAT YOU’VE WRITTEN?

That’s like asking me to choose between my children! If I have to choose, I will go with a paper that I published with Shana Clor-Proell (from TCU) and my Texas McCombs colleague Lisa Koonce. The paper is titled, “How do experienced users evaluate hybrid financial instruments?” It was published in the Journal of Accounting Research in 2016. Hybrids—financial instruments that have characteristics of both debt and equity—are a tricky issue in accounting because it is difficult to know how to classify them on the balance sheet. In the paper, we find that experienced finance professionals rely primarily on disclosed features of hybrid financial instruments, rather than their classification, suggesting that accounting standard setters may want to focus on disclosure. It’s been a fun paper in part because we have had the opportunity to discuss it with board members at the FASB and IASB.

ON THE OTHER HAND… FAVORITE PUBLICATION THAT YOU’VE READ?

That’s a tough one too! I’m going to go with Jeffrey Hales’ 2007 paper, “Directional preferences, information processing, and investors’ forecasts of earnings,” published in the Journal of Accounting Research. That was the paper that convinced me I wanted to do behavioral research in financial accounting. Jeff shows that simply holding stock in a company can change investors’ beliefs about the company’s future performance via a cognitive process known as motivated reasoning.

WHAT IS SOMETHING THAT MANY PEOPLE DO NOT KNOW ABOUT YOU?

I played the bass guitar in a number of different bands in high school and college. Maybe even more unbelievable is that at the same time I had long, curly hair!

SHERYLL COX, Senior Academic Advisor

SHERYLL COX, Senior Academic Advisor EMILY STROMAN, Associate Academic Advisor

EMILY STROMAN, Associate Academic Advisor JASON TASSET, Director of Academic Services

JASON TASSET, Director of Academic Services