Check out the views from the home offices of our MPA advising team, who are currently meeting with MPA students virtually as they register for classes and prepare for graduation.

SHERYLL COX, Senior Academic Advisor

SHERYLL COX, Senior Academic Advisor

Number of years at UT: 8

PROS OF WORKING FROM HOME: Having lunch with my sons, as they are both attending school virtually.

CONS OF WORKING FROM HOME: I miss the interaction with my students and colleagues (and walks to our campus Target).

EMILY STROMAN, Associate Academic Advisor

EMILY STROMAN, Associate Academic Advisor

Number of years at UT: 1

PROS OF WORKING FROM HOME: Spending extra time with my fur babies and my husband, Kyle.

CONS OF WORKING FROM HOME: I don’t have as many food options; I’m limited to what’s in my fridge.

JASON TASSET, Director of Academic Services

JASON TASSET, Director of Academic Services

Number of years at UT: 20

PROS OF WORKING FROM HOME: Lunchtime walks with my dogs and playing my music loudly.

CONS OF WORKING FROM HOME: It’s tough not seeing my coworkers or taking breaks at the Blanton Museum.

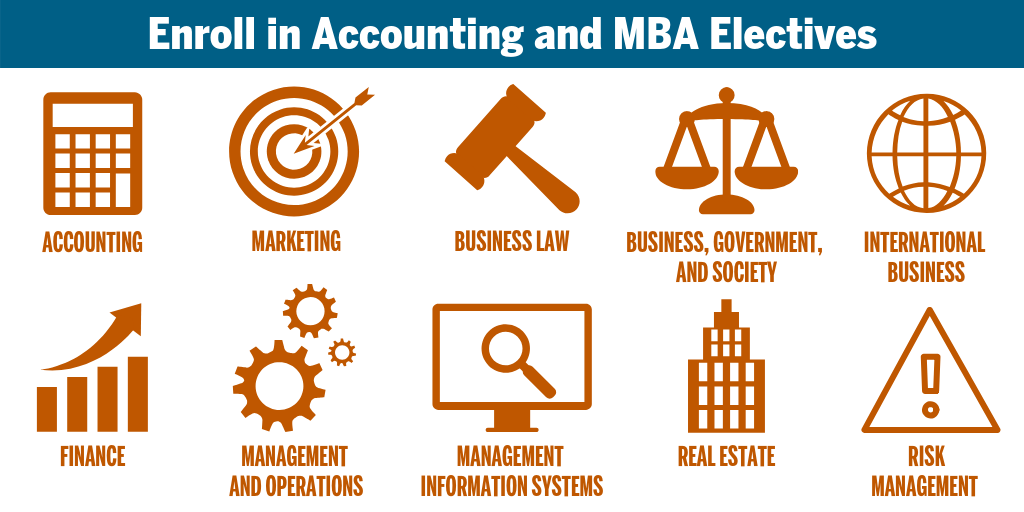

Explore the Master in Professional Accounting academic experience by visiting our website. You’ll learn more about the MPA coursework and how it aligns with your specific career goals. Tracks, various accounting and MBA electives, and an optional internal audit certificate program are all offered within the program.